Another article espousing the cause of demonetization!! Worth reading

November 15, 2016

When cash is not king

In one fell swoop, demonetisation has struck a blow to the parallel economy.

In a new tryst with destiny, once again at the stroke of the midnight hour on November 8-9,

Narendra Modi effectively demonetised large denomination notes in India. Of the Rs.16 lakh crore-plus in circulation, Rs.500 and Rs.1,000 notes account for about Rs.14 lakh crore and more than 85 per cent by value of all rupee bills in circulation, as per Reserve Bank of India data. With this master stroke, the Prime Minister has walked the talk and shown that when it comes to doing the right thing, and eliminating the wrong, he doesn’t spare even the corrupt in his own party. He has effectively dealt a death knell to the private businesses of all politicians, lawyers and bureaucrats.

All those craving for big-bang reforms couldn’t have asked for more — corruption cannot thrive where money is traceable and Mr. Modi’s is a significant step against big-ticket corruption and black money. The secrecy with which it was conceived and executed has left the nation stunned. It is far bigger in scope and scale than those attempted ever before in independent India, and is the first of many bold steps which perhaps only this Prime Minister could have done for disrupting the business model of Indian politics forever.

Parallel transaction networks

At the heart of it is the simple proposition that large currency notes are used more to conceal than to purchase. Mr. Modi has converted this one sentence into an economic manna in his avowed fight against black money and corruption, which is laudable.

Peter Sands of Harvard Kennedy School, one of the proponents of this idea of killing large currency notes, one later supported by former U.S. Treasury Secretary Larry Summers, argues that a million dollars in $20 bills weighs 110 pounds or about four suitcases, whereas in 500-euro notes, less than 4 pounds, making the former very hard to transport. The U.S. stopped issuing $500 notes in 1969, the European Central Bank halted 500-euro notes early this year, and Singapore killed its $10,000 note and Canada its $1,000 note in 2000. India has one of the highest cash to GDP ratios at 12 per cent (excluding the parallel economy) and despite a well-publicised amnesty scheme, the fear of god had not sunk in. Now it will, with Mr. Modi’s big-bang step.

Mr. Sands illustrates by arguing that bulk cash transfer plays a role in more complex drug trafficking and money-laundering schemes. Cash couriered from Paris to Belgium was used to buy gold, which in turn was couriered to Dubai, where it was made into jewellery which was sold in India with the profits then wired back to France. This network was estimated to launder 170 million euros per year. And this is an example of one transaction network — imagine how many more are out there in the world! India’s black economy is estimated to be $400-500 billion, larger than several economies of the world, and almost $3.5 billion is spent in currency operation costs annually, as per Tufts University’s Cost of Cash study. On purchasing power basis, Rs.500 and Rs.1,000 notes are large by Indian standards even though they may not be as per exchange rates.

Short-term pain, long-term benefits

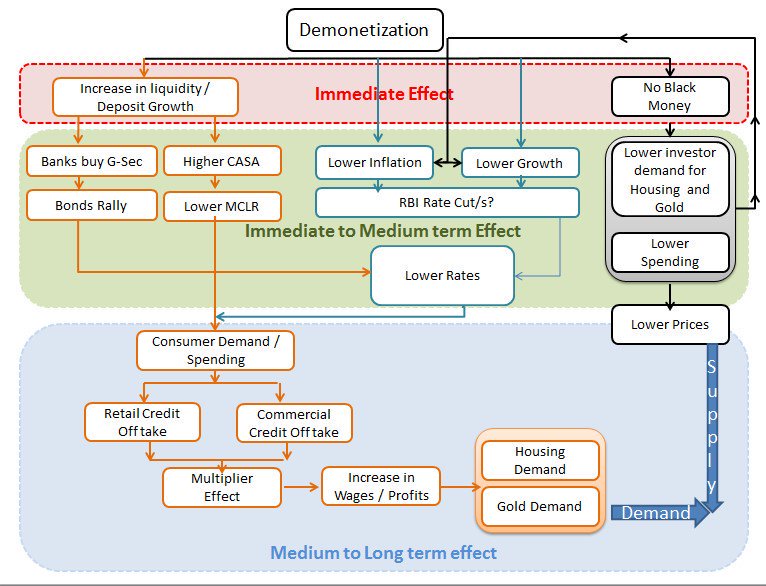

Indeed, there will be some contraction in money supply and thus a slight deflationary impact, which will cause some inconvenience in the very short term to the average citizen, which the Prime Minister has acknowledged repeatedly in his speech, but this will be compensated by significant benefits in the long term for all law-abiding citizens.

The deflationary impact could be felt in sectors where cash is the main instrument of transaction and perhaps in some asset prices as well, such as in real estate. In the longer term, it will lead to a greater proportion of the economy shifting from black to white. Those who hold large amounts of cash may, if they deposit it in banks and perhaps pay taxes on it, be forced to join the white economy. It may also raise permanently the cost of holding cash by adding a risk premium. This may encourage people to take the certainty of paying taxes in lieu of the uncertainty of holding black cash.

Real estate firms or jewellers may not accept cash unless it is at a good discount, for they will have to declare it to the banks and pay taxes. So there is no easy option to convert it via real estate or gold. It skews incentives against cash purchases, and gives a fillip to card transactions.

The hawala network also won’t accept non-legal tender and the ultimate end user anywhere in the world will be stuck with worthless pieces of paper after December 30, 2016. So a person will, at best, exchange it at a discount for the next 50 days.

The next big hit should be on purchase of benami property which is a national avocation, for that’s perhaps the other big outlet and repository of black money. When the Goods and Services Tax comes into force, the government should do away with stamp duty on land at any stage of the sale; moreover, the tax rates on purchase of property should be dramatically slashed. This apart, election funding reforms and online voting are all big steps in the continuum of reforms, of which this was just the first big step.

The incentives for honesty have been improved, dramatically, with this reform measure, much needed after it was last done in 1978. This will seriously affect the stock of black money but the effect on future flows is unpredictable. However, the flows will perhaps be reduced because of the increased risk perception in cash transactions. Further, the government should take steps to increase mobile penetration, pre-bundled with cash apps, which will make it easier for those who wish to go digital.

Cash is the new trash and the Prime Minister has acted decisively, ending reams of debates, declamations and declarations. Changing human behaviour is the hardest thing to do in the world — Mr. Modi is doing just that in one of the most difficult ecosystems in the world. As a small aside, he has also dealt a body blow to ‘terror money’, and electoral politics in India will never be the same again.

http://www.thehindu.com/opinion/op-ed/when-cash-is-not-king/article9346128.ece?homepage=true