-

This forum contains old posts that have been closed. New threads and replies may not be made here. Please navigate to the relevant forum to create a new thread or post a reply.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

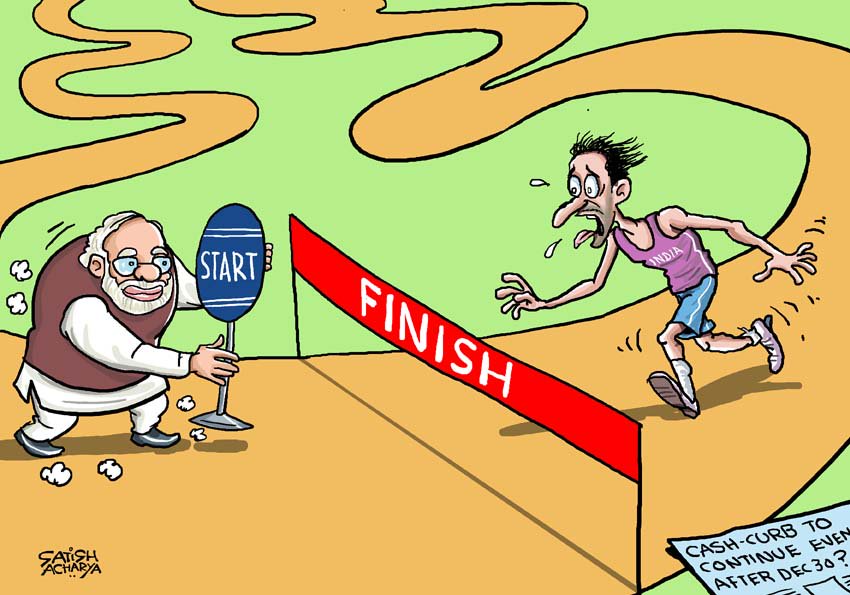

Demonetisation: Will it lead to a corruption free India?

- Thread starter vgane

- Start date

- Status

- Not open for further replies.

The only way the people with black money could have exchanged their Old 500 , 1000 Rupee notes is through gold ( bars and jewellary ) and new 2000 rupee notes . New 2000 Rupee notes are being circulated to the black money hoarders through back channels with the blessings of select RBI and Bank Officials at the Top . As regards Gold , Jewellary it would have been done with the blessings of some select jewellars , Gold Merchants again through back channels .

Lot of Politicians help were also resorted to deposit black money ( Rs.45,000 in each account ) in the Jan Dhan accounts of their Low Income Group Party Cadres in small towns ( again with the blessings of the Bank Officials and Political Connections ) .

Hope these guys are caught through accelerated surveillance and action post Dec 31st as promised by our PM!

prasad1

Active member

Why are the IT raids are being conducted in NON-BJP controlled state? The IT officers are being protected only by CRPF.

Do people have faith in these "encounters"? Has any major political figure ever found guilty and punished for having wealth beyond normal means?

Deployment of Central forces to provide security to Income Tax officials during search operations and raids is not a new phenomenon, but is used sparingly, officials said, responding to criticism from West Bengal Chief Minister Mamata Banerjee.

Do people have faith in these "encounters"? Has any major political figure ever found guilty and punished for having wealth beyond normal means?

CRPF men deployed outside the residence of Tamil Nadu Chief Secretary P. Rama Mohana Rao at Anna Nagar in Chennai on Wednesday.

prasad1

Active member

“Every citizen can join this mahayajna against the ills of corruption, black money and fake notes... Let us ignore the temporary hardship.”

It is now 48 days since Prime Minister Narendra Modi made that appeal, as he scrapped 86% of India’s bank note--by value--in circulation. Initially, millions of Indians queuing up to withdraw their own money from bank accounts did indeed ignore the hardship of lost wages and stress of the queue. The common refrain: It’s worth it because the rich with black money will suffer. As it becomes increasingly evident that only those in the queue are suffering, as are livelihoods, the lines are as long as ever and people have died waiting for money, there is a distinct change in mood.

Over the last week, there have been attacks on banks in Uttarakhand, Haryana and Uttar Pradesh, and roads have been blocked by frustrated mobs in UP. Images of hundreds pressing against a bank entrance’s steel grill, narrowed to allow one person to enter, appear to have become the leitmotif of the era of notebandi, the colloquial term for Modi’s grand experiment. The patience displayed in the queue has given way to jokes, frustration and abuse and eroded the government’s credibility.

Government spokespersons insist there is no shortage of money. They may not be entirely wrong. Every day, India is witness to law-enforcement agencies seizing bundles of the distinctive, pink bundles of Rs 2,000-denomination bank notes. Those in queue ask the obvious question: We stand here for days to get a few thousands, how do they get lakhs and crores?

The short answer is corruption, the very thing notebandi is supposed to strike at. A vast money laundering exercise in India’s unseen financial netherworld appears to have been largely successful, as the anticipated return of almost all the money that was taken out of the banking system indicates (The government thought Rs 2.5 lakh crore or so in unaccounted money would not return). Some of those with unaccounted or “black” money did get their comeuppance, but those numbers are likely to be far smaller than anticipated.

How could this happen? It could happen because Indians are masters of subversion and because notebandi was a shot in the dark, with no precise target or preparation to overcome this culture of subversion. So, corrupt bank officers colluded easily with corrupt seekers of pink notes. Thus far, about 50 bank officials from private and public banks and the Reserve Bank of India have been found conspiring with money launderers--many more have got away. Bundles of pink notes continue to turn up in cars, homes, offices and bank lockers. Bear in mind that these instances only relate to cash. Thousands of crores of unaccounted rupees were converted to real estate, gold and luxury items, from watches to handbags.

Modi has either not understood the reach of corruption into India’s administrative system and collective soul or he did understand but was convinced by his circle of trusted bureaucrats that a series of administrative fiats — surgical strikes, to use popular government nomenclature — without adequate planing could, somehow, bring about the new normal that he seeks.

Corruption in India is like water — it finds a way. It is marked by ingenuity, determination and perseverance, qualities that could transform India if deployed for honest means. The most ingenious method recently evident: Thousands of poor Indians with basic bank accounts persuaded — for a fee, obviously — to rent their accounts to launder old bank notes into new.

It isn’t politically correct to say this, but the majority in India is dishonest, either by circumstance, culture, upbringing or habit. I would like to believe many can be turned if circumstances change, but that may be optimistic, given the casual and widespread disregard of laws in every sphere of life, most visible in the form of the roadside havaldar who waits for a Rs-50 bribe from the streams of vehicles that run red lights. Corruption in India can only be curbed through carrots, sticks, meticulous planning and sustained effort. Incentives are important; so is stronger punishment. As former chief economic adviser Kaushik Basu has argued, it may make sense to decriminalise the giving of bribes.

However, most important is administrative and political reform.

In 2007, the second Administrative Reforms Commission made 18 recommendations to enforce ethics in political and legislative functions. All 18 were rejected. Politicians have consistently closed ranks over political reform, and Modi has stayed within those ranks. Indeed, in the budget session of Parliament earlier this year, his government tweaked foreign contribution laws to allow political parties to receive foreign donations retrospectively, from 2010. As soon as this amendment passed, the Congress and BJP, held guilty by the Delhi High Court of accepting foreign donations illegally, withdrew their appeal from the Supreme Court. Yet, Modi said last week that his party had not altered even “a comma or a full stop” in the law that regulated political funding. Some honesty would be in order.

Many commentators have also pointed out how political parties need not account for donations below Rs 20,000. It is no surprise that in 2014-15 six leading political parties received 60% of their funding from “unknown” sources, and the BJP received the most such funding with Rs 977 crore over two years.

The systemic eradication of corruption also requires reconstructing an administrative system largely unchanged since colonial rule. Modi began well: Some old laws were scrapped and business requirements eased. But the bureaucracy and its rusting frame still remains India’s backbone and the tentacles of the inspector raj are as tightly wound around the economy as ever. We have also seen the right-to-information system eroded, no Lokpal--whatever its infirmities--is in evidence, and, now, the efforts to find notebandi’s laundered money portend a greater bureaucratic invasion of our lives, which Modi had once promised to reverse (remember “minimum governance”?). Without a carefully planned, wide-ranging — and honest — war of reform against politics and the bureaucracy, no isolated surgical strike can survive its overstated claims.

http://www.hindustantimes.com/opini...finds-a-way/story-4jbxeQupa1BiJ07ZXTENiL.html

It is now 48 days since Prime Minister Narendra Modi made that appeal, as he scrapped 86% of India’s bank note--by value--in circulation. Initially, millions of Indians queuing up to withdraw their own money from bank accounts did indeed ignore the hardship of lost wages and stress of the queue. The common refrain: It’s worth it because the rich with black money will suffer. As it becomes increasingly evident that only those in the queue are suffering, as are livelihoods, the lines are as long as ever and people have died waiting for money, there is a distinct change in mood.

Over the last week, there have been attacks on banks in Uttarakhand, Haryana and Uttar Pradesh, and roads have been blocked by frustrated mobs in UP. Images of hundreds pressing against a bank entrance’s steel grill, narrowed to allow one person to enter, appear to have become the leitmotif of the era of notebandi, the colloquial term for Modi’s grand experiment. The patience displayed in the queue has given way to jokes, frustration and abuse and eroded the government’s credibility.

Government spokespersons insist there is no shortage of money. They may not be entirely wrong. Every day, India is witness to law-enforcement agencies seizing bundles of the distinctive, pink bundles of Rs 2,000-denomination bank notes. Those in queue ask the obvious question: We stand here for days to get a few thousands, how do they get lakhs and crores?

The short answer is corruption, the very thing notebandi is supposed to strike at. A vast money laundering exercise in India’s unseen financial netherworld appears to have been largely successful, as the anticipated return of almost all the money that was taken out of the banking system indicates (The government thought Rs 2.5 lakh crore or so in unaccounted money would not return). Some of those with unaccounted or “black” money did get their comeuppance, but those numbers are likely to be far smaller than anticipated.

How could this happen? It could happen because Indians are masters of subversion and because notebandi was a shot in the dark, with no precise target or preparation to overcome this culture of subversion. So, corrupt bank officers colluded easily with corrupt seekers of pink notes. Thus far, about 50 bank officials from private and public banks and the Reserve Bank of India have been found conspiring with money launderers--many more have got away. Bundles of pink notes continue to turn up in cars, homes, offices and bank lockers. Bear in mind that these instances only relate to cash. Thousands of crores of unaccounted rupees were converted to real estate, gold and luxury items, from watches to handbags.

Modi has either not understood the reach of corruption into India’s administrative system and collective soul or he did understand but was convinced by his circle of trusted bureaucrats that a series of administrative fiats — surgical strikes, to use popular government nomenclature — without adequate planing could, somehow, bring about the new normal that he seeks.

Corruption in India is like water — it finds a way. It is marked by ingenuity, determination and perseverance, qualities that could transform India if deployed for honest means. The most ingenious method recently evident: Thousands of poor Indians with basic bank accounts persuaded — for a fee, obviously — to rent their accounts to launder old bank notes into new.

It isn’t politically correct to say this, but the majority in India is dishonest, either by circumstance, culture, upbringing or habit. I would like to believe many can be turned if circumstances change, but that may be optimistic, given the casual and widespread disregard of laws in every sphere of life, most visible in the form of the roadside havaldar who waits for a Rs-50 bribe from the streams of vehicles that run red lights. Corruption in India can only be curbed through carrots, sticks, meticulous planning and sustained effort. Incentives are important; so is stronger punishment. As former chief economic adviser Kaushik Basu has argued, it may make sense to decriminalise the giving of bribes.

However, most important is administrative and political reform.

In 2007, the second Administrative Reforms Commission made 18 recommendations to enforce ethics in political and legislative functions. All 18 were rejected. Politicians have consistently closed ranks over political reform, and Modi has stayed within those ranks. Indeed, in the budget session of Parliament earlier this year, his government tweaked foreign contribution laws to allow political parties to receive foreign donations retrospectively, from 2010. As soon as this amendment passed, the Congress and BJP, held guilty by the Delhi High Court of accepting foreign donations illegally, withdrew their appeal from the Supreme Court. Yet, Modi said last week that his party had not altered even “a comma or a full stop” in the law that regulated political funding. Some honesty would be in order.

Many commentators have also pointed out how political parties need not account for donations below Rs 20,000. It is no surprise that in 2014-15 six leading political parties received 60% of their funding from “unknown” sources, and the BJP received the most such funding with Rs 977 crore over two years.

The systemic eradication of corruption also requires reconstructing an administrative system largely unchanged since colonial rule. Modi began well: Some old laws were scrapped and business requirements eased. But the bureaucracy and its rusting frame still remains India’s backbone and the tentacles of the inspector raj are as tightly wound around the economy as ever. We have also seen the right-to-information system eroded, no Lokpal--whatever its infirmities--is in evidence, and, now, the efforts to find notebandi’s laundered money portend a greater bureaucratic invasion of our lives, which Modi had once promised to reverse (remember “minimum governance”?). Without a carefully planned, wide-ranging — and honest — war of reform against politics and the bureaucracy, no isolated surgical strike can survive its overstated claims.

http://www.hindustantimes.com/opini...finds-a-way/story-4jbxeQupa1BiJ07ZXTENiL.html

Why are the IT raids are being conducted in NON-BJP controlled state? The IT officers are being protected only by CRPF.

Do people have faith in these "encounters"? Has any major political figure ever found guilty and punished for having wealth beyond normal means?

Plenty of raids have been done in Mumbai which is part of Maharashtra, a BJP ruled state. Comparatively few in WB which is ruled by Mamata didi. Why are we suddenly assuming political vendetta.

Regarding other corrupt figures, as has been said: Abhi to aap sirf trailer dekhe hain. Picture abhi baaki hai dost.

GANESH65

Active member

LATEST

TRENDING

After Notes Ban, 104 Crores Added In Account Of Mayawatis Party: Story Highlights

Rs 1.43 crore deposited in Anand Kumar's account, say sources

Another Rs. 104 crore deposited in an account belonging to the BSP

The Delhi bank is being investigated by the Enforcement Directorate

New Delhi: Around Rs 104 crore have been deposited in an account belonging to the Bahujan Samaj Party or BSP since the central government's announcement on currency ban, sources in the Enforcement Directorate have said. Another Rs 1.43 crore have been deposited in the account of former party chief Mayawati's brother, the investigators said.

The Enforcement Directorate zeroed in on the accounts while conducting searches on a branch of the Union Bank. It was one of the banks being being investigated to check on possible cases of money laundering after the government scrapped the two high denomination notes.

Agency sources said money had been deposited in the accounts of Anand Kumar and the BSP since the ban on 500 and 1000 rupee notes was announced by Prime Minister Narendra Modi on November 8. While the name of the branch is yet to be disclosed, the search operation is still on, sources said.

Under the Income Tax Act, the income of political parties is exempt from tax provided all donations above Rs. 20,000 are taken by cheque and lower ones are properly documented, with full details of the donors. These accounts also have to be audited.

Days after the currency ban, finance minister Arun Jaitley had said political parties can also deposit their cash held in the old currency in banks till December 30 without having to pay tax, provided they can explain the source of income. But he said the parties cannot accept donations in the banned currency and their books of accounts should reflect the entries prior to November 8.

The BSP is one of the key players in the coming assembly elections in the state, scheduled to be held next year.

Following the ban on high denomination currency, which the government said was meant to check corruption and flush out black money, the Congress had alleged that the move was political and made only for winning the assembly elections in Uttar Pradesh.

http://m.ndtv.com/india-news/after-...yawatis-brothers-bank-account-sources-1642083

TRENDING

After Notes Ban, 104 Crores Added In Account Of Mayawatis Party: Story Highlights

Rs 1.43 crore deposited in Anand Kumar's account, say sources

Another Rs. 104 crore deposited in an account belonging to the BSP

The Delhi bank is being investigated by the Enforcement Directorate

New Delhi: Around Rs 104 crore have been deposited in an account belonging to the Bahujan Samaj Party or BSP since the central government's announcement on currency ban, sources in the Enforcement Directorate have said. Another Rs 1.43 crore have been deposited in the account of former party chief Mayawati's brother, the investigators said.

The Enforcement Directorate zeroed in on the accounts while conducting searches on a branch of the Union Bank. It was one of the banks being being investigated to check on possible cases of money laundering after the government scrapped the two high denomination notes.

Agency sources said money had been deposited in the accounts of Anand Kumar and the BSP since the ban on 500 and 1000 rupee notes was announced by Prime Minister Narendra Modi on November 8. While the name of the branch is yet to be disclosed, the search operation is still on, sources said.

Under the Income Tax Act, the income of political parties is exempt from tax provided all donations above Rs. 20,000 are taken by cheque and lower ones are properly documented, with full details of the donors. These accounts also have to be audited.

Days after the currency ban, finance minister Arun Jaitley had said political parties can also deposit their cash held in the old currency in banks till December 30 without having to pay tax, provided they can explain the source of income. But he said the parties cannot accept donations in the banned currency and their books of accounts should reflect the entries prior to November 8.

The BSP is one of the key players in the coming assembly elections in the state, scheduled to be held next year.

Following the ban on high denomination currency, which the government said was meant to check corruption and flush out black money, the Congress had alleged that the move was political and made only for winning the assembly elections in Uttar Pradesh.

http://m.ndtv.com/india-news/after-...yawatis-brothers-bank-account-sources-1642083

Last edited:

prasad1

Active member

Plenty of raids have been done in Mumbai which is part of Maharashtra, a BJP ruled state. Comparatively few in WB which is ruled by Mamata didi. Why are we suddenly assuming political vendetta.

Regarding other corrupt figures, as has been said: Abhi to aap sirf trailer dekhe hain. Picture abhi baaki hai dost.

If you are regular in this thread you would have noticed that a comment was made by Vaagmiji that all Hoards of new currency was only in NON-bjp states. My observation was that all the IT raids reported till that time was from Delhi, Hyderabad, Bangluru etc. The raids in Surat, Mumbai and other cities in BJP control were delayed. No Vendatta was ever mentioned.

A bonanza to real estate sector in the next 6 months to 1 year when interest rate cuts happen, as banks are flush with funds, leading to more investments in real estate!

Demonetization will make real estate sector stronger and healthier

Demonetization today is becoming synonymous to chaos, confusion and inconvenience. However, putting aside the short-term perspective, it is bound to come as a blessing in disguise, as India is set for a digital revolution and the overall payments landscape of the country is up for a complete overhaul.

Published: December 29, 2016 5:23 PM

Atul Banshal

Demonetization today is becoming synonymous to chaos, confusion and inconvenience. However, putting aside the short-term perspective, it is bound to come as a blessing in disguise, as India is set for a digital revolution and the overall payments landscape of the country is up for a complete overhaul. Delivering his speech at an event recently, Mr. Ravi Shankar Prasad, Law and IT Minister, said that with digital transactions money will come into system, it will be accountable, generate tax and develop the country’s economy. When money will come into banks, the government will be able to come up with better welfare schemes. This will actually strengthen government machinery for better implementation of schemes.

For real estate, it might be a short-term itch — particularly for land deals, commercial transactions, hospitality or retail. Small builders and those in specific cities/ micro markets where cash dealing was more prevalent will be most impacted. Registration prices in residential space may also go up to adjust for cash component. Therefore, resale of property will be impacted more than primary sales. Organized real estate sector may also face demand slowdown for a short while, largely due to ‘wait and watch’ susceptibility of buyers and investors.

However, gradually, once banks have a high lending capacity with money in the system, we will see a decent lowering of interest rates. Lower interest rates will bring down the EMIs on home loans, making real estate more affordable and attractive. Precedents suggest that low interest rates give the real estate industry a massive boost by escalating positive sentiment and demand, especially in the residential segment. Also, if supply of resale properties declines due to price crash, it may favorably impact primary sales. We also need to consider the fact that while real estate comes as an asset and offers handsome appreciation with time, it also helps in income tax deductions. Rentals also add as an earning potential from a property.

Also, as a positive impact of demonetization, banking systems are bound to witness a windfall of funds, increasing their lending capacity and in turn driving down the interest rates. High lending capacity of banks offers benefits to overall industrial and business ecosystem, strengthening the overall economic conditions of the country. Therefore, in the longer run this will have an upward impact on the purchasing power of the people instigating demands in all sectors, including real estate. The year 2016 has witnessed some positive and potentially long-lasting changes being introduced in the Indian real estate. The passing of RERA (Real Estate Regulation and Development Act 2016), the Benami Transactions Act and now the demonetization move will ensure that going forward, the sector will lose much of its historic taint and become more transparent. These moves will ensure increased transparency, improved investor confidence, better access to funding and higher FDI.

So, if we have to measure an overall impact on the real estate sector, it can be safely said that real estate will be a much more attractive investment option than volatile / lower-return offering bullion, equity or bank deposits. The Indian real estate sector will emerge stronger, healthier and capable of long periods of sustained growth. As of now, there is no reason for developers and investors, who have conducted their dealings transparently and legally. to panic.

(The author is President-Accounts & Finance, M3M India Pvt Ltd)

http://www.financialexpress.com/mon...state-sector-stronger-and-healthier-2/490214/

Demonetization will make real estate sector stronger and healthier

Demonetization today is becoming synonymous to chaos, confusion and inconvenience. However, putting aside the short-term perspective, it is bound to come as a blessing in disguise, as India is set for a digital revolution and the overall payments landscape of the country is up for a complete overhaul.

Published: December 29, 2016 5:23 PM

Atul Banshal

Demonetization today is becoming synonymous to chaos, confusion and inconvenience. However, putting aside the short-term perspective, it is bound to come as a blessing in disguise, as India is set for a digital revolution and the overall payments landscape of the country is up for a complete overhaul. Delivering his speech at an event recently, Mr. Ravi Shankar Prasad, Law and IT Minister, said that with digital transactions money will come into system, it will be accountable, generate tax and develop the country’s economy. When money will come into banks, the government will be able to come up with better welfare schemes. This will actually strengthen government machinery for better implementation of schemes.

For real estate, it might be a short-term itch — particularly for land deals, commercial transactions, hospitality or retail. Small builders and those in specific cities/ micro markets where cash dealing was more prevalent will be most impacted. Registration prices in residential space may also go up to adjust for cash component. Therefore, resale of property will be impacted more than primary sales. Organized real estate sector may also face demand slowdown for a short while, largely due to ‘wait and watch’ susceptibility of buyers and investors.

However, gradually, once banks have a high lending capacity with money in the system, we will see a decent lowering of interest rates. Lower interest rates will bring down the EMIs on home loans, making real estate more affordable and attractive. Precedents suggest that low interest rates give the real estate industry a massive boost by escalating positive sentiment and demand, especially in the residential segment. Also, if supply of resale properties declines due to price crash, it may favorably impact primary sales. We also need to consider the fact that while real estate comes as an asset and offers handsome appreciation with time, it also helps in income tax deductions. Rentals also add as an earning potential from a property.

Also, as a positive impact of demonetization, banking systems are bound to witness a windfall of funds, increasing their lending capacity and in turn driving down the interest rates. High lending capacity of banks offers benefits to overall industrial and business ecosystem, strengthening the overall economic conditions of the country. Therefore, in the longer run this will have an upward impact on the purchasing power of the people instigating demands in all sectors, including real estate. The year 2016 has witnessed some positive and potentially long-lasting changes being introduced in the Indian real estate. The passing of RERA (Real Estate Regulation and Development Act 2016), the Benami Transactions Act and now the demonetization move will ensure that going forward, the sector will lose much of its historic taint and become more transparent. These moves will ensure increased transparency, improved investor confidence, better access to funding and higher FDI.

So, if we have to measure an overall impact on the real estate sector, it can be safely said that real estate will be a much more attractive investment option than volatile / lower-return offering bullion, equity or bank deposits. The Indian real estate sector will emerge stronger, healthier and capable of long periods of sustained growth. As of now, there is no reason for developers and investors, who have conducted their dealings transparently and legally. to panic.

(The author is President-Accounts & Finance, M3M India Pvt Ltd)

http://www.financialexpress.com/mon...state-sector-stronger-and-healthier-2/490214/

tbs

0

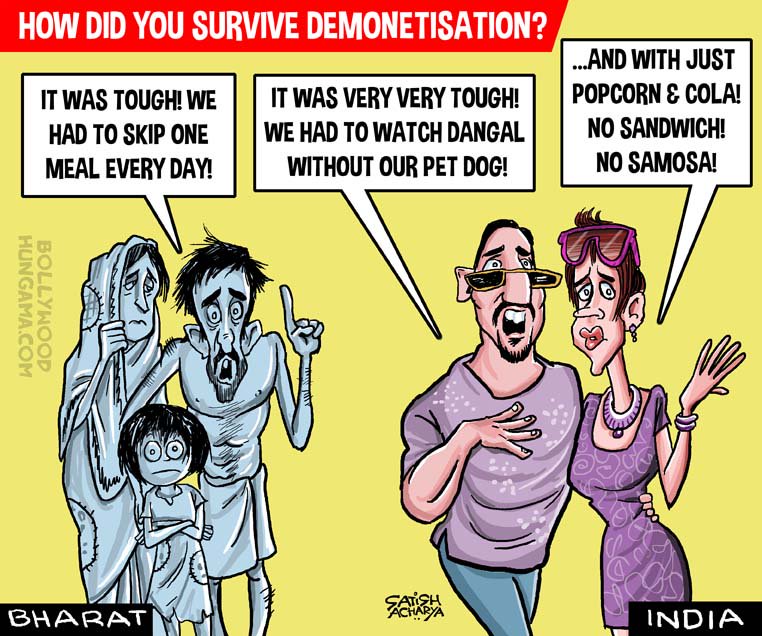

hiiiThe dichotomy is apparent! With plethora of plastic money the rich could manage the demonetization but the poor & lower middle class suffered! Hope our PM takes this into account while drafting his New Year eve address!

it means BHARAT IS POOR.....INDIA IS RICH...

Brahmanyan

Active member

I am surprised by the knee jerk reaction of the educated lot on demonetisation. Is It not a fact that most of the people do not use ATM route for taking cash, instead they go to Bank to withdraw cash by self cheque.

This is bold move by the Government to bring the untaxed black money into the system, by levying tax and penalty. Yes, since this is an unprecedented route taken by Mr Modi, it has to undergo a lot of changes. Common man in the street understand and go through the suffering patiently.

Today the position has improved a lot. The new currency is available in most of the places. It is only natural that in the initial stages, people have a tendency to withhold new currency from circulation the result of which is called "Gresham's law" in economics.

This is only a beginning. Government has to take a lot of follow up action to get the results, which will take months, or even years.

Brahmanyan

Bangalore.

This is bold move by the Government to bring the untaxed black money into the system, by levying tax and penalty. Yes, since this is an unprecedented route taken by Mr Modi, it has to undergo a lot of changes. Common man in the street understand and go through the suffering patiently.

Today the position has improved a lot. The new currency is available in most of the places. It is only natural that in the initial stages, people have a tendency to withhold new currency from circulation the result of which is called "Gresham's law" in economics.

This is only a beginning. Government has to take a lot of follow up action to get the results, which will take months, or even years.

Brahmanyan

Bangalore.

I am surprised by the knee jerk reaction of the educated lot on demonetisation. Is It not a fact that most of the people do not use ATM route for taking cash, instead they go to Bank to withdraw cash by self cheque.

This is bold move by the Government to bring the untaxed black money into the system, by levying tax and penalty. Yes, since this is an unprecedented route taken by Mr Modi, it has to undergo a lot of changes. Common man in the street understand and go through the suffering patiently.

Today the position has improved a lot. The new currency is available in most of the places. It is only natural that in the initial stages, people have a tendency to withhold new currency from circulation the result of which is called "Gresham's law" in economics.

This is only a beginning. Government has to take a lot of follow up action to get the results, which will take months, or even years.

Brahmanyan

Bangalore.

Brahmanyan Sir, With due respects, because the idea of demonetization itself is not new, the only thing to be judged is how it got implemented and the implementation has been shoddy. The move is bold and may have been undertaken with best intentions but the constant changing of rules does not inspire any confidence. Plus the focus has shifted to cashless transactions putting lot of strain on a vast majority of people. Instead of letting the market decide , the govt is promoting the interests of private players in the area of digital transactions. If the govt enforces ID requirement for every purchase or banking transaction, it is a serious intrusion of privacy as well. I am not sure for how long all these faults can stack against the one positive thing that can be claimed ..that of minimizing or eliminating corruption.

nkripashankar

Active member

Smartphone_AP Image used for representational purpose only | AP

NEW DELHI: Prime Minister Narendra Modi on Friday launched an Aadhaar-based mobile payment application at Digi Dhan Mela here to promote and make digital transactions easier.

The app is called BHIM (Bharat Interface for Money) -- a re-branded version of UPI (Unified Payment Interface) and USSD (Unstructured Supplementary Service Data).

Speaking on the occasion, Modi said BHIM app was very simple to use and a thumb impression was enough to operate it.

"Be it a smartphone or feature phone of Rs 1,000-1,200, BHIM app can be used. There is no need to have Internet connectivity. One only needs a thumb. There was a time when an illiterate was called 'angutha chchap'. Now, time has changed. Your thumb is your bank now. It has become your identity now."

Modi said that 'Lucky Grahak Yojana' and 'DigiDhan Vyapar Yojana' were a Chrismas gift to the nation.

Over 100 days, several prizes of Rs 1,000 will be given to people through lucky draws. The mega draw will be held on April 14, the birth anniversary of Babasaheb Bhimrao Ambedkar.

This will nearly halve the number of times one goes to ATM!! Will queues get normal? Queues are likely to reduce significantly..Normalcy may be by March!!

[h=1]Withdrawal limit from ATMs hiked to Rs 4,500/day from January 1[/h]December 31, 2016 00:21 IST

The RBI notification said there is no change in weekly withdrawal limits and such disbursals should predominantly be in the denomination of Rs 500

In a relief to common man, the Reserve Bank said cash withdrawal limit from ATMs will be increased to Rs 4,500 per day from the current Rs 2,500 from January 1.

However, there has been no change in the weekly withdrawal limit, which stands at Rs 24,000, including from ATM, for individuals (Rs 50,000 in case of small traders).

"On a review of the position, the daily limit of withdrawal from ATMs has been increased (within the overall weekly limits specified) with effect from January 1, 2017, from the existing Rs 2,500 to Rs 4,500 per day per card," the central bank said in a notification.

Following demonetisation of old Rs 500/1000 notes on November 9, limits had been imposed on withdrawal of cash from banks as well as ATMs.

The Reserve Bank's notification further stated "there is no change in weekly withdrawal limits" and such disbursals "should predominantly be in the denomination of Rs 500".

Earlier in the day, the RBI had permitted White Label ATM Operators (WLAOs) to source cash from retail outlets.

Most of the White Label ATMs are running dry since demonetisation as the operators were facing difficulties in sourcing cash from their sponsor bank(s).

Friday, December 30, was the last day to deposit the invalid currency notes in banks. However, people still have time to exchange the currency notes at designated RBI counters till March 31 after giving valid reasons for not depositing defunct notes in their accounts by December 30.

http://www.rediff.com/business/repo...ked-to-rs-4500day-from-january-1/20161231.htm

[h=1]Withdrawal limit from ATMs hiked to Rs 4,500/day from January 1[/h]December 31, 2016 00:21 IST

The RBI notification said there is no change in weekly withdrawal limits and such disbursals should predominantly be in the denomination of Rs 500

In a relief to common man, the Reserve Bank said cash withdrawal limit from ATMs will be increased to Rs 4,500 per day from the current Rs 2,500 from January 1.

However, there has been no change in the weekly withdrawal limit, which stands at Rs 24,000, including from ATM, for individuals (Rs 50,000 in case of small traders).

"On a review of the position, the daily limit of withdrawal from ATMs has been increased (within the overall weekly limits specified) with effect from January 1, 2017, from the existing Rs 2,500 to Rs 4,500 per day per card," the central bank said in a notification.

Following demonetisation of old Rs 500/1000 notes on November 9, limits had been imposed on withdrawal of cash from banks as well as ATMs.

The Reserve Bank's notification further stated "there is no change in weekly withdrawal limits" and such disbursals "should predominantly be in the denomination of Rs 500".

Earlier in the day, the RBI had permitted White Label ATM Operators (WLAOs) to source cash from retail outlets.

Most of the White Label ATMs are running dry since demonetisation as the operators were facing difficulties in sourcing cash from their sponsor bank(s).

Friday, December 30, was the last day to deposit the invalid currency notes in banks. However, people still have time to exchange the currency notes at designated RBI counters till March 31 after giving valid reasons for not depositing defunct notes in their accounts by December 30.

http://www.rediff.com/business/repo...ked-to-rs-4500day-from-january-1/20161231.htm

Brahmanyan

Active member

Dear Sri Kalabhairavan,கால பைரவன்;370188 said:Brahmanyan Sir, With due respects, because the idea of demonetization itself is not new, the only thing to be judged is how it got implemented and the implementation has been shoddy. The move is bold and may have been undertaken with best intentions but the constant changing of rules does not inspire any confidence. Plus the focus has shifted to cashless transactions putting lot of strain on a vast majority of people. Instead of letting the market decide , the govt is promoting the interests of private players in the area of digital transactions. If the govt enforces ID requirement for every purchase or banking transaction, it is a serious intrusion of privacy as well. I am not sure for how long all these faults can stack against the one positive thing that can be claimed ..that of minimizing or eliminating corruption.

Agreed the idea is not new. But the circumstances are different. In view of the confidentiality of the operation, Government cannot prepare openly , eventhough some preparations like printing of currency of two thousand rupees started much early.

Curruption and resultant black money have been allowed to enter into the system undisturbed for years by the previous Governments the economic situation have gone completely out of control. It is great that a leader of impeccable character and commitment has come to the scene to rescue the Nation from a great disaster.

We should appreciate this multi-pronged operation is used to get the system prepare the nation ready to enter cashless transactions, with the use of modern technology.

We as a nation enjoy unfettered freedom, even minor changes to discipline the system disturb us.

This is only a beginning of an great initiative which should be followed up with other operations to clean up the system

Regards,

Brahmanyan

Bangalore.

prasad1

Active member

The 500 and 1000 rupee notes were scrapped to target so-called 'black money' Together the two notes represented 86% of the currency in circulation and there have been chaotic scenes in India ever since, with people having to spend hours queuing outside banks and cash machines which have been running out of money.

ATM queues and cash withdrawal limits mean getting currency can still be tricky, and there have been several changes of the rules around how much money people can access or deposit.

The government hopes the measures will encourage more people to have bank accounts and move towards a society less reliant on cash.

But there are concerns that many poorer people and those in rural areas have yet to get bank accounts.

Local firms which allow people to make digital payments both online and in shops have reported a surge in transactions as people look for cashless alternatives.

The government says the move has been a success with the banks flush with cash and significant increases in tax collection.

But critics argue the move has failed to root out corruption and unearth illegal cash, since most of the money in circulation has been put back into the financial system. Instead, they say, the economy which was growing at a rapid pace, has slowed down significantly.

ATM queues and cash withdrawal limits mean getting currency can still be tricky, and there have been several changes of the rules around how much money people can access or deposit.

The government hopes the measures will encourage more people to have bank accounts and move towards a society less reliant on cash.

But there are concerns that many poorer people and those in rural areas have yet to get bank accounts.

Local firms which allow people to make digital payments both online and in shops have reported a surge in transactions as people look for cashless alternatives.

The government says the move has been a success with the banks flush with cash and significant increases in tax collection.

But critics argue the move has failed to root out corruption and unearth illegal cash, since most of the money in circulation has been put back into the financial system. Instead, they say, the economy which was growing at a rapid pace, has slowed down significantly.

I would like to just point out that the topic of this thread is: Will demonetisation lead to a corruption free India? No that: Will India become corruption free on Dec 31, 2016?

Footnote: There is no country which is completely corruption free today: not even the great USA, Russia, China, UK, Israel, Saudi etc. Maybe only Bhutan has a chance!

Footnote: There is no country which is completely corruption free today: not even the great USA, Russia, China, UK, Israel, Saudi etc. Maybe only Bhutan has a chance!

V

V.Balasubramani

Guest

I would like to just point out that the topic of this thread is: Will demonetisation lead to a corruption free India? No that: Will India become corruption free on Dec 31, 2016?

Footnote: There is no country which is completely corruption free today: not even the great USA, Russia, China, UK, Israel, Saudi etc. Maybe only Bhutan has a chance!

Sir,

You are right.

But the Forum has a bunch of Modi Bashers who come here to argue based on assumptions mostly..

Last edited by a moderator:

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 1K

- Replies

- 0

- Views

- 831

- Replies

- 2

- Views

- 1K