[h=1]2016-17 in review: Start-ups look to conserve cash[/h]Valuation markdowns, executive departures, job cuts and market share losses to US rivals dominated headlines in first half of 2016-17 but things are looking up now

Sayan Chakraborty

Hike and Paytm E-commerce were the only start-ups that joined the unicorn club in 2016-17. Photo: Bloomberg

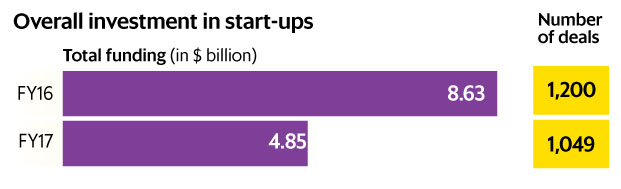

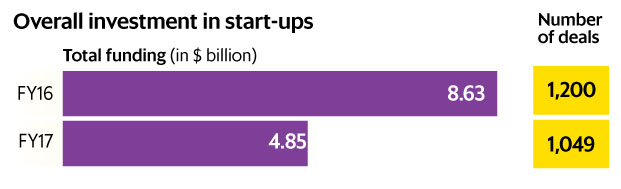

In the financial year ending today, funding slowed sharply for Indian start-ups.

Valuation markdowns, executive departures, job cuts and market share losses to American rivals dominated the headlines in the first half of the financial year, which conspicuously lacked big-ticket fund raises.

After the addition of four companies in the unicorn club in the previous financial year, just two—messaging app Hike and Paytm E-commerce, an entity spun out of One97 Communications—made it to the list this year. In the second half of the year, things finally started picking up. There’s strong evidence to show that after a year-long crisis, Flipkart is holding its own against Amazon India. Ditto Ola against Uber. Both Flipkart and Ola are in talks to close large rounds of financing that will put to rest doubts about their ability to take on their American rivals, at least in the short term.

Another large start-up Snapdeal, however, is fighting for its life. As its cash reserves dwindled and it missed out on several financing offers, Snapdeal was forced to cut jobs and spending. Snapdeal is now in talks with Paytm and Flipkart for a potential sale. Other unicorns such as Zomato, Quikr and Shopclues are also in cash-conserve mode.

Overall investment in start-ups

Click here for enlarge

Click here for enlarge

Paytm was undoubtedly the star of the year. Its valuation soared some three times to nearly $6 billion in a recent share sale by some of its investors such as Saama Capital and Reliance Capital, which made a killing on their early bets in the payments rm. Paytm showed impressive growth in the rst half of the year, helped by tens of millions of new users. However, it was India’s demonetisation exercise which gave the company its biggest boost. Paytm pounced on the opportunity and left rivals such as Freecharge and MobiKwik reeling. The company’s position in payments currently seems like a near monopoly.

Biggest funding rounds of the year

Click here for enlarge

Click here for enlarge

Software start-ups became the new investor darlings amid the gloom in the consumer Internet business. Freshdesk, backed by Accel Partners and Tiger Global, became the breakthrough enterprise software start-up, offering hope to investors that SaaS (software as a service) start-ups may be much more capital-efficient bets than their consumer internet peers.

Investment in SaaS start-ups

Click here for enlarge

Click here for enlarge

The year also saw several start-ups down shutters as funding became hard to come by and competition intensified.

Top five start-up shutdowns during the year

http://www.livemint.com/Companies/k...in-review-Startups-look-to-conserve-cash.html

Sayan Chakraborty

Hike and Paytm E-commerce were the only start-ups that joined the unicorn club in 2016-17. Photo: Bloomberg

In the financial year ending today, funding slowed sharply for Indian start-ups.

Valuation markdowns, executive departures, job cuts and market share losses to American rivals dominated the headlines in the first half of the financial year, which conspicuously lacked big-ticket fund raises.

After the addition of four companies in the unicorn club in the previous financial year, just two—messaging app Hike and Paytm E-commerce, an entity spun out of One97 Communications—made it to the list this year. In the second half of the year, things finally started picking up. There’s strong evidence to show that after a year-long crisis, Flipkart is holding its own against Amazon India. Ditto Ola against Uber. Both Flipkart and Ola are in talks to close large rounds of financing that will put to rest doubts about their ability to take on their American rivals, at least in the short term.

Another large start-up Snapdeal, however, is fighting for its life. As its cash reserves dwindled and it missed out on several financing offers, Snapdeal was forced to cut jobs and spending. Snapdeal is now in talks with Paytm and Flipkart for a potential sale. Other unicorns such as Zomato, Quikr and Shopclues are also in cash-conserve mode.

Overall investment in start-ups

Click here for enlarge

Click here for enlargePaytm was undoubtedly the star of the year. Its valuation soared some three times to nearly $6 billion in a recent share sale by some of its investors such as Saama Capital and Reliance Capital, which made a killing on their early bets in the payments rm. Paytm showed impressive growth in the rst half of the year, helped by tens of millions of new users. However, it was India’s demonetisation exercise which gave the company its biggest boost. Paytm pounced on the opportunity and left rivals such as Freecharge and MobiKwik reeling. The company’s position in payments currently seems like a near monopoly.

Biggest funding rounds of the year

Click here for enlarge

Click here for enlargeSoftware start-ups became the new investor darlings amid the gloom in the consumer Internet business. Freshdesk, backed by Accel Partners and Tiger Global, became the breakthrough enterprise software start-up, offering hope to investors that SaaS (software as a service) start-ups may be much more capital-efficient bets than their consumer internet peers.

Investment in SaaS start-ups

Click here for enlarge

Click here for enlargeThe year also saw several start-ups down shutters as funding became hard to come by and competition intensified.

Top five start-up shutdowns during the year

http://www.livemint.com/Companies/k...in-review-Startups-look-to-conserve-cash.html