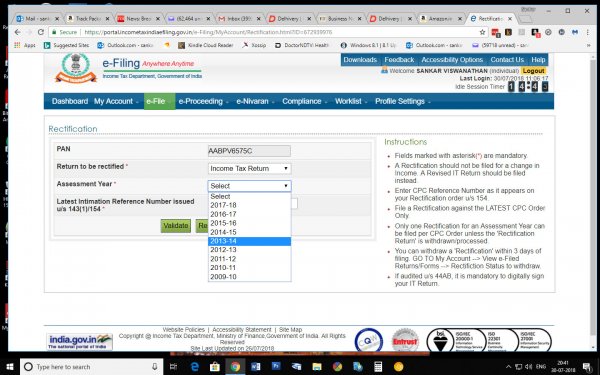

I had submitted my Income Tax return on line. I wanted to correct the return. But when i went to the rectification page the assessment year 2018-19 is not there in the dropdown menu.

https://www.incometaxindiaefiling.gov.in/home

I am enclosing a screenshot of the web page so that you will understand my situation.

Has anyone faced this problem? How do i overcome this?

https://www.incometaxindiaefiling.gov.in/home

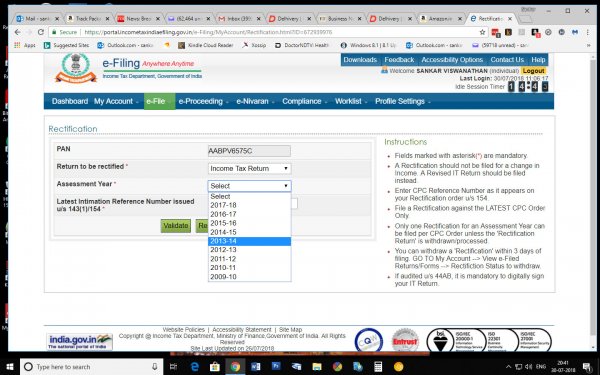

I am enclosing a screenshot of the web page so that you will understand my situation.

Has anyone faced this problem? How do i overcome this?