Dhar, Jhabua and Khargone districts (Madhya Pradesh): Santosh Bavash, 30, said he knew about the Internet. “I’ve heard it tells you about the future,” he told IndiaSpend when we spoke to the short and thin labourer, from the village of Gyanpura, in the western district of Dhar, in Madhya Pradesh (MP), one of India’s poorest states.

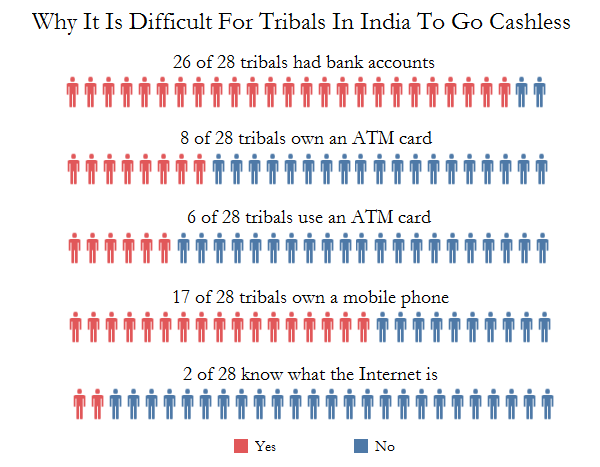

After the withdrawal of Rs 14 lakh crore–86% by value of Indian currency in circulation–the government has pushed for digital payments to counter the lack of notes in the economy. Of the 28 tribals IndiaSpend met in a state with more tribals than any other, all but two had a bank account (92.8%), 17 had a personal cell phone and knew how to use it (60.7), six owned an ATM card and knew how to use it (21.4%), and two knew about the Internet (7.1%), an indication of the the gulf between Prime Minister Narendra Modi’s vision of a “digital” or “cashless” economy and the reality in India’s most disadvantaged areas.

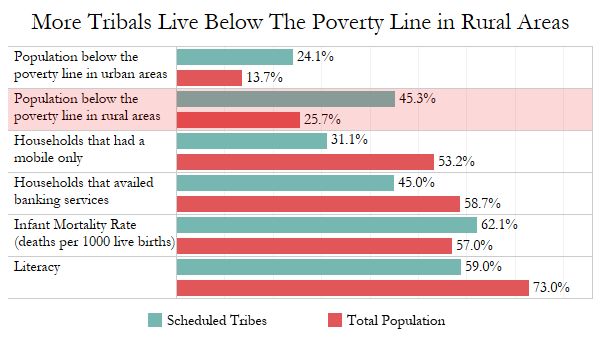

India has 104 million tribals, 8.6% of the total population. MP has 14.69% of India’s tribal population (15.3 million). Tribals have lower access to banking services, lower income, education levels, and health outcomes than the rest of the population, according to data from Census 2011, and the socio-economic caste census.

India has 104 million tribals, 8.6% of the total population. MP has 14.69% of India’s tribal population (15.3 million). Tribals have lower access to banking services, lower income, education levels, and health outcomes than the rest of the population, according to data from Census 2011, and the socio-economic caste census.

Why tribals are more unprepared than other Indians for the cashless eraA small group of men and women sat on a raised platform, as a child played on a makeshift swing hanging from a tree. To one side lay farmland, to the other, houses. This was the village of Footiya, in the MP district of Jhabua, along the border with Gujarat. Footiya is inhabited predominantly by adivasis, or tribals, and does not have a post office, a cooperative or commercial bank, an ATM, or a public phone booth, according to information from Census 2011.

Zumla (he uses only one name), a tall, well-built man with a white moustache, also sat under the tree. He said he had had a bank account for years now, but rarely used it because he had little money to deposit into the account, and because going to a bank took very long. It takes him an hour to walk to the nearest bank branch, about 6 km from the village, he said.

“I am anguthachaap,” Zumla, a Bhil tribal with a white turban, added in Hindi, using the term for a thumb impression, a sign of illiteracy. “I use a chequebook (he meant passbook) to put in money and take out money, but I don’t know how to use an ATM,” said Zumla, dressed in a grey shirt paired with a white dhoti tied above the knees. “If I can’t read, how do I know what buttons to press?”

The district of Jhabua–over 91% of all households here are classified as scheduled tribe, the term in the Indian constitution for tribals–has one of the lowest rural literacy levels in the state. Less than half of the population in the district (40.1%), and less than one third of the women (29.8%), in rural areas is literate, according to 2011 Census data.

Tribals in these areas were mostly farmers or non-agricultural labourers. Farmers said they had been offered lower prices for their harvest than they had expected, and blamed the withdrawal of currency for the lower prices.

“I have been making a loss of Rs 8 per kg on cotton (the main cash crop in the area),” said Gappu, the tribal from the village of Rui, in Khargone district, when IndiaSpend spoke to him on December 6, 2016. “I still sell 5-10 kg every other day at Rs 42 per kg because we need it for household expenses and for paying off debts,” he explained.

Other farmers said they were putting off selling until the prices increased in the market. Syana Natya, a maize farmer from Rui, said the family had put off selling any corn until prices increased. “They are offering Rs 8-9 a kg, but we expect Rs 12-13 a kg,” he said. He added that some traders had offered a cheque but he didn’t have a bank account and didn’t know how he would use one, as he was uneducated.Others said the local shops had continued to take old notes in the days soon after the withdrawal of notes, but would cut an extra Rs 50-100 over the cost of the items bought. “Shops looted us, and we couldn’t do anything,” said Rajesh Damod, 35, a labourer from Namkheda village, in Dhar district. He added that new notes of Rs 2,000 had reached the village but it was difficult to get change.

Read more at:

http://www.sify.com/finance/cashless-india-if-i-cant-read-how-do-i-know-what-buttons-to-press-news-finance-qmwk2bigdbfgj.html