prasad1

Active member

While the media gaze has been on start-ups in trouble, investors who funded them have mostly escaped attention, says Ranju Sarkar

The rise and fall of Nikesh Arora at SoftBank, in some sense, symbolises how the investor sentiment has changed with Indian start-ups: moving from a period of exuberance to one of extreme caution within two years.

Start-ups that did not have a business model and, hence, could not grow or attract new funding, are shutting shop.

A dozen start-ups have shut down so far in 2016 (calendar year), after a similar number last year.

Several others are struggling to stay afloat. About 30 of them have been acqui-hired by another start-up.

While the media gaze has been on start-ups in trouble, investors who funded them have mostly escaped attention.

"Everyone has lost money. But, it will be good to find out what SoftBank has done. They are in big trouble, in terms of amounts and in terms of being the last investor to get stuck at high valuation," says a venture capital (VC) investor.

SoftBank invested $90 million in Housing.com and valued OYO Rooms at $400 million.

"Nikesh Arora over-paid for every deal. There's a fallacy among some: if a company raises more money, it will last longer (if it is the last man standing, it will still win)," says an investor.

It may still work in categories like taxi aggregation. Investors say VC firms with a Silicon Valley background are able to raise more money from global investors as they have the ability to sell their US and global experience to investors.

India is different, though. "Most people who left India 10-20 years ago have no clue, and have no connection with the ground situation here. Such investors come, park themselves in some fancy hotel, invest money and go away with the hope that like in the US and China, they will make money here. But, they lose," says another VC who does not wish to be named.

Some investors do make money initially, but that's luck.

"First, it was Silicon Valley investors like Draper Fisher Jurvetson, with the famous outrage by its Mohanjit Jolly against Indians, and now its executives from big Japanese, US funds. These people come here, lose money and then are forced to bow out," says the VC quoted above.

Shutdowns

Shutdowns

Barring half-a-dozen well-funded start-ups that shut shop, most start-ups that downed shutters had not received significant funding and had only raised early-stage money.

While there has not been a lot of capital erosion so far, it is likely if some well-funded start-ups like Housing, OYO Rooms etc., fail.

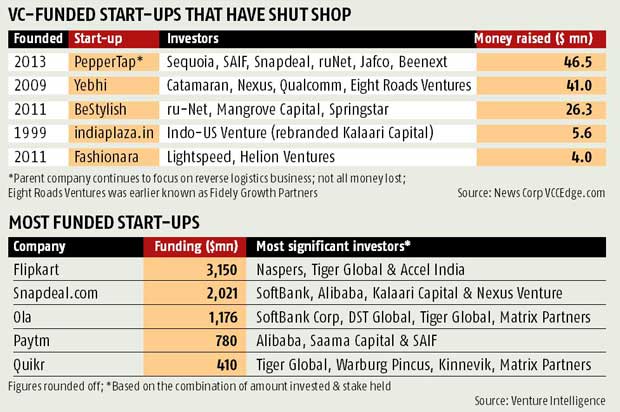

Investors have lost money in some well-funded start-ups that shut shop: Sequoia and Matrix in TinyOwl ($46 million); Catamaran, Nexus, and Qualcomm in Yebhi ($41 million); ruNet, Mangrove Capital, and Springstar in BeStylish ($26.3 million), Indo-US Venture, Matrix, Draper Fisher Jurvetson in SeventyMM ($20 million); Indo-US Venture in Indiaplaza; Lightspeed and Helion in Fashionara.

http://www.rediff.com/business/repo...om-the-story-of-indias-start-ups/20160721.htm

The rise and fall of Nikesh Arora at SoftBank, in some sense, symbolises how the investor sentiment has changed with Indian start-ups: moving from a period of exuberance to one of extreme caution within two years.

Start-ups that did not have a business model and, hence, could not grow or attract new funding, are shutting shop.

A dozen start-ups have shut down so far in 2016 (calendar year), after a similar number last year.

Several others are struggling to stay afloat. About 30 of them have been acqui-hired by another start-up.

While the media gaze has been on start-ups in trouble, investors who funded them have mostly escaped attention.

"Everyone has lost money. But, it will be good to find out what SoftBank has done. They are in big trouble, in terms of amounts and in terms of being the last investor to get stuck at high valuation," says a venture capital (VC) investor.

SoftBank invested $90 million in Housing.com and valued OYO Rooms at $400 million.

"Nikesh Arora over-paid for every deal. There's a fallacy among some: if a company raises more money, it will last longer (if it is the last man standing, it will still win)," says an investor.

It may still work in categories like taxi aggregation. Investors say VC firms with a Silicon Valley background are able to raise more money from global investors as they have the ability to sell their US and global experience to investors.

India is different, though. "Most people who left India 10-20 years ago have no clue, and have no connection with the ground situation here. Such investors come, park themselves in some fancy hotel, invest money and go away with the hope that like in the US and China, they will make money here. But, they lose," says another VC who does not wish to be named.

Some investors do make money initially, but that's luck.

"First, it was Silicon Valley investors like Draper Fisher Jurvetson, with the famous outrage by its Mohanjit Jolly against Indians, and now its executives from big Japanese, US funds. These people come here, lose money and then are forced to bow out," says the VC quoted above.

Barring half-a-dozen well-funded start-ups that shut shop, most start-ups that downed shutters had not received significant funding and had only raised early-stage money.

While there has not been a lot of capital erosion so far, it is likely if some well-funded start-ups like Housing, OYO Rooms etc., fail.

Investors have lost money in some well-funded start-ups that shut shop: Sequoia and Matrix in TinyOwl ($46 million); Catamaran, Nexus, and Qualcomm in Yebhi ($41 million); ruNet, Mangrove Capital, and Springstar in BeStylish ($26.3 million), Indo-US Venture, Matrix, Draper Fisher Jurvetson in SeventyMM ($20 million); Indo-US Venture in Indiaplaza; Lightspeed and Helion in Fashionara.

http://www.rediff.com/business/repo...om-the-story-of-indias-start-ups/20160721.htm