-

Welcome to Tamil Brahmins forums.

You are currently viewing our boards as a guest which gives you limited access to view most discussions and access our other features. By joining our Free Brahmin Community you will have access to post topics, communicate privately with other members (PM), respond to polls, upload content and access many other special features. Registration is fast, simple and absolutely free so please, join our community today!

If you have any problems with the registration process or your account login, please contact contact us.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

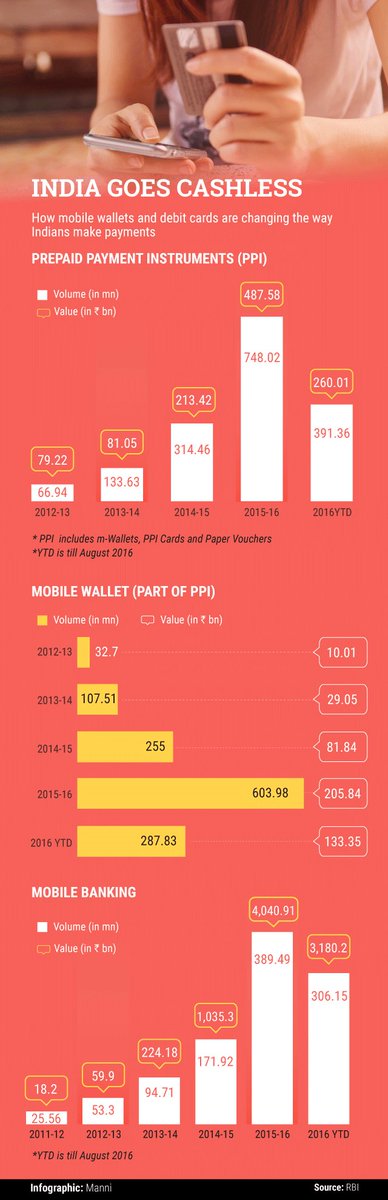

How India is moving cashless?

- Thread starter vgane

- Start date

- Status

- Not open for further replies.

Not sure how mobile banking is contributing to cashless? Do Indian merchants support Android and Apple Pay?

Most of air booking are made on the mobile..Both Make my trip and yatra support Android and iOS...Even IRCTC for rail reservation supports these

GANESH65

Active member

One of ther reason people prefer mobile or online payment is to avoid que. Cash payments are only accepted at designated counters and you tend to spent a lot of time in ques. The on line revolution has given freedom from ques.. and of course carrying e-cash is lot easier also .

Most of air booking are made on the mobile..Both Make my trip and yatra support Android and iOS...Even IRCTC for rail reservation supports these

That is true, but that is not a particular mobile payment system. The same "cashless" situation exists for desktop web sites.

I would categorize mobile payment separately if they used some specific mobile technology e.g. NFC. Otherwise, it is similar to any other computer.

NFC adoption is not widespread..RBI has set a limit of Rs 2000 per transaction as security issues are still to be tackled...Visa has started with 1 million cards...100K merchants are having this..A small trickle

http://www.medianama.com/2016/06/223-visa-nfc-cards-terminals/

http://www.medianama.com/2016/06/223-visa-nfc-cards-terminals/

Last edited:

V

V.Balasubramani

Guest

You will be able to swipe your debit/credit card at railway ticket counter soon

Indian Railways is finally going cashless andwill now have a Point of Sale (PoS) machines at its ticket booking counter. Onthe lines of demonetisation, the railways has asked banks such as StateBank of India(SBI) and ICICI, etc to provide nearly 15,000 PoSmachines at reservation counters.

The machines are expected to be made available byDec 31. Presently, there is no PoS machine and travellers have to pay throughcash.

"We have around 12,000 ticket counters. Allof them would be equipped with one or more POS machines depending on the dailytransactions. Managing cash is also a huge task for our staff. It would bebeneficial for them as well if we could have enough swipe machines,” a seniorrail board official told ET.

Source: http://www.businessinsider.in/credit-card-at-railway-ticket-counter-soon/articleshow/55744554.cms

V

V.Balasubramani

Guest

Following demonetisation, TTD plans to boost 'cashless' pilgrimage to Tirumala

The TTD is also phasing out the usage of demonetised notes in the temple town.

Despite seeing a massive boost in revenue collection in the form of cash dropped into 'hundis' by pilgrims after demonetisation, the

Tirumala Tirupati Devasthanam (TTD) is planning to go the digital way.

The TTD is also phasing out the usage of demonetised notes in the temple town.

………………….

…………………….

"In order to hold accountability and ease day-to-day transactions, the TTD Board has made arrangements for e-donations, e-hundi, e-publications, e-challan, e-darshan, e-accommodation and e-seva,” an official told the Financial Express.

Meanwhile, a TTD board member told the newspaper, "The online booking, arjitha seva tickets, accommodation, e-hundi, demat, e-books are just a few to mention. But still there is a long way to go and need to integrate the system by developing a next generation application."

The TTD, which manages the richest Hindu temple in the world, has stated that it clocks around 1 lakh visitors on a daily basis, and a Hundi collection of nearly Rs 1.5 to Rs 2 crore every day.

It is also interesting to note, that the collection figure went up after Rs 500 and Rs 1,000 notes were made illegal tender.

Reports add that 5.13 lakh pilgrims visited in the eight days that followed demonetisation, and the hundi registered a whopping Rs 22.9 crore.

.............................

..............................

Source: http://www.thenewsminute.com/articl...lans-boost-cashless-pilgrimage-tirumala-53788

The TTD is also phasing out the usage of demonetised notes in the temple town.

Despite seeing a massive boost in revenue collection in the form of cash dropped into 'hundis' by pilgrims after demonetisation, the

Tirumala Tirupati Devasthanam (TTD) is planning to go the digital way.

The TTD is also phasing out the usage of demonetised notes in the temple town.

………………….

…………………….

"In order to hold accountability and ease day-to-day transactions, the TTD Board has made arrangements for e-donations, e-hundi, e-publications, e-challan, e-darshan, e-accommodation and e-seva,” an official told the Financial Express.

Meanwhile, a TTD board member told the newspaper, "The online booking, arjitha seva tickets, accommodation, e-hundi, demat, e-books are just a few to mention. But still there is a long way to go and need to integrate the system by developing a next generation application."

The TTD, which manages the richest Hindu temple in the world, has stated that it clocks around 1 lakh visitors on a daily basis, and a Hundi collection of nearly Rs 1.5 to Rs 2 crore every day.

It is also interesting to note, that the collection figure went up after Rs 500 and Rs 1,000 notes were made illegal tender.

Reports add that 5.13 lakh pilgrims visited in the eight days that followed demonetisation, and the hundi registered a whopping Rs 22.9 crore.

.............................

..............................

Source: http://www.thenewsminute.com/articl...lans-boost-cashless-pilgrimage-tirumala-53788

V

V.Balasubramani

Guest

[h=1]Now, Kanpur’s Anandeshwar Temple to accept cashless donations[/h]The Anandeshwar Temple has decided to accept cashless donations for ‘shringar’ and ‘rudrabhishek’ rituals to support Prime Minister Narendra Modi’s war against black money.

Situated on the banks of the Ganga, the temple has applied for GPRS-enabled point-of-sale terminals (card swiping machines) to help devotees donate through debit and credit cards.

“The PM’s mission is important to weed out black money from the system,” head priest of Anandeshwar Temple Ramesh Puri Maharaj told HT.

“The temple administration believes going cashless will set an example for the people. Cashless transactions will be accepted for ‘shringar’ and ‘rudrabhishek’ while the cash coming in donation boxes will be deposited in the bank,” he said.

The temple has applied for PoS machines from Gwaltoli branch of Punjab National Bank where the temple has its accounts. Cash swiping machines will be available at the temple later this week.

Read more at: http://www.hindustantimes.com/india...s-donations/story-ZxbRy8ktHShcQQI4gt0HpN.html

Situated on the banks of the Ganga, the temple has applied for GPRS-enabled point-of-sale terminals (card swiping machines) to help devotees donate through debit and credit cards.

“The PM’s mission is important to weed out black money from the system,” head priest of Anandeshwar Temple Ramesh Puri Maharaj told HT.

“The temple administration believes going cashless will set an example for the people. Cashless transactions will be accepted for ‘shringar’ and ‘rudrabhishek’ while the cash coming in donation boxes will be deposited in the bank,” he said.

The temple has applied for PoS machines from Gwaltoli branch of Punjab National Bank where the temple has its accounts. Cash swiping machines will be available at the temple later this week.

Read more at: http://www.hindustantimes.com/india...s-donations/story-ZxbRy8ktHShcQQI4gt0HpN.html

V

V.Balasubramani

Guest

Source: Face book

V

V.Balasubramani

Guest

[h=1]Demonetisation: Toll plazas to receive payment through credit, debit cards[/h]New Delhi: All toll plazas in national highways will receive payments through credit or debit cards and e-wallet henceforth besides accepting old currency notes of Rs 500 till 15 December.

Read more at: http://www.firstpost.com/india/demo...yment-through-credit-debit-cards-3140976.html

Read more at: http://www.firstpost.com/india/demo...yment-through-credit-debit-cards-3140976.html

prasad1

Active member

Cashless transactions, especially through cards, are turning out to be a major problem for consumers as well as merchants. Overloaded and slow online servers are leading to delay in transactions, many of which are often aborted, leaving consumers in the lurch.

Another issue is that shopkeepers have a minimum purchase threshold for accepting card payment. Most traders accept card payment only on purchases above Rs250. Also, some traders insist on a 2% transaction charge for accepting payment through cards, despite the Centre waiving off these charges till December 31.

These problems are proving a major obstacle to the Central government’s plan to increase the scale of cashless transactions.

“A card has to be swiped twice or thrice before the transaction is approved. This is happening since mid-November after the currency shortage started,” Naveen Kumar, a wholesale grocery seller in Sadar Bazaar, said.

Kumar’s trade was based solely on cash, but he bought a GPRS enabled card swipe machine for Rs23,000 as he was losing customers. Since Kumar is new to using the device, he is left wondering why transactions are declined or the machine fails to respond for a long time.

Manoj Yadav, who works at a petrol station on Pataudi Road, said that the move towards a cashless country is burdening the existing infrastructure.

“Many sellers and traders have bought these machines recently and it has put additional load on servers. Our machines never hung or got slow earlier, but now, a card has to be swiped repeatedly to complete a transaction,” Yadav said.

Residents said that shopkeepers’ refusal to credit/debit card for a purchase less than Rs250 is a major problem as there is a shortage of cash.

A retailer at Ram Nagar said, “We do not accept card payments if the amount is less than Rs250 as it incurs charges for us.”

Siddharth Arora, a paediatrician, said he was asked to pay extra to make a cashless transaction. “I got my hair cut at a salon in South City-2. The charge for the cut was Rs70, but I was asked to pay Rs90 if payment was to be made through my card. I tried to make the stylist understand that the charges have been waived off and finally managed to pay only Rs70,” Arora said.

The Haryana government, on November 14, ordered all businesses to accept payments made through cheque, demand draft, and online methods as there is a shortage of currency notes. The government had also authorised deputy commissioners to initiate action against violators.

http://www.hindustantimes.com/gurga...ss-payments/story-zfNPyAli4S7SynXVKCu9xO.html

I have been writing about this.

Another issue is that shopkeepers have a minimum purchase threshold for accepting card payment. Most traders accept card payment only on purchases above Rs250. Also, some traders insist on a 2% transaction charge for accepting payment through cards, despite the Centre waiving off these charges till December 31.

These problems are proving a major obstacle to the Central government’s plan to increase the scale of cashless transactions.

“A card has to be swiped twice or thrice before the transaction is approved. This is happening since mid-November after the currency shortage started,” Naveen Kumar, a wholesale grocery seller in Sadar Bazaar, said.

Kumar’s trade was based solely on cash, but he bought a GPRS enabled card swipe machine for Rs23,000 as he was losing customers. Since Kumar is new to using the device, he is left wondering why transactions are declined or the machine fails to respond for a long time.

Manoj Yadav, who works at a petrol station on Pataudi Road, said that the move towards a cashless country is burdening the existing infrastructure.

“Many sellers and traders have bought these machines recently and it has put additional load on servers. Our machines never hung or got slow earlier, but now, a card has to be swiped repeatedly to complete a transaction,” Yadav said.

Residents said that shopkeepers’ refusal to credit/debit card for a purchase less than Rs250 is a major problem as there is a shortage of cash.

A retailer at Ram Nagar said, “We do not accept card payments if the amount is less than Rs250 as it incurs charges for us.”

Siddharth Arora, a paediatrician, said he was asked to pay extra to make a cashless transaction. “I got my hair cut at a salon in South City-2. The charge for the cut was Rs70, but I was asked to pay Rs90 if payment was to be made through my card. I tried to make the stylist understand that the charges have been waived off and finally managed to pay only Rs70,” Arora said.

The Haryana government, on November 14, ordered all businesses to accept payments made through cheque, demand draft, and online methods as there is a shortage of currency notes. The government had also authorised deputy commissioners to initiate action against violators.

http://www.hindustantimes.com/gurga...ss-payments/story-zfNPyAli4S7SynXVKCu9xO.html

I have been writing about this.

prasad1

Active member

The demonetisation move by the Centre is turning out to be a nightmare for over 1 lakh construction workers in the city. Labour department sources said that 10,000-12,000 daily wage workers have already left Gurgaon.

In the absence of work and cash, a majority of the seasonal workers are struggling to make ends meet. To get a clearer picture, the labour department has also ordered a survey.

Gurgaon is a hub of real estate industry, where around 40,000-50,000 workers migrate to every season. An equal number stay for more than a year, but all workers have been affected.

“Construction work in the unorganised sector has almost come to a standstill and the real estate industry is also witnessing a slowdown. There is no work for labourers and they also don’t have the cash to pay rent, buy food, or send it home,” Rajender Saroha, district convener, Bhawan Nirman Kamgar Union, Gurgaon, said.

A majority of the workers in Gurgaon come from Rajasthan, Madhya Pradesh, Uttar Pradesh and Bihar. They start arriving in August and continue to do so till December. Most stay here till March, before agricultural operations resume in their villages.

“There is no work at the labour chowks. People don’t want to pay the wages owed due to the cash crunch. Some even offer work against the scrapped ₹500 and ₹1,000 notes, which is a joke,” Kripal Singh, a worker from Dausa in Rajasthan, said.

Officials, who have been visiting labour chowks and construction sites to open bank accounts for workers said that the crowd was getting thinner by the day.

“The number of people looking for work at labour chowks in sectors 9, 17, 12, 18, 56, Bhuteshwar temple, Bristol Chowk and Ghata village is decreasing every day,” Saroha said.

Workers earn ₹450-₹550 per day and a skilled mason earns up to ₹700 per day, however, the wage on offer is also lower at present. “No one is ready to offer work. Those who do are willing to pay only half the salary,” Banwari, who works as a mason, said.

Desraj, the state president of Kamgar union, said that the condition of workers across Haryana is miserable. He highlighted the plight of brick kiln workers in Jhajjar, who are unable to subsist due to the cash crunch.

The realty sector, which was already in a slowdown, has been hit hard by the demonetisation, builders said. “At many real estate sites, work was stopped due to slowdown as well as due to NGT order. Now, the note ban has made things even more difficult as there is no cash to buy materials or pay wages,” a realtor said.

The Gurgaon labour department officials said that they are carrying out a survey of workers and are also helping them open bank accounts. “Reverse migration has increased, no doubt, but there is no need to panic. We are opening bank accounts to help workers and a survey will soon give us the exact status,” Jaibeer Arya, additional labour commissioner, Gurgaon, said.

Meanwhile, workers said that they will leave town for good if things do not improve soon.

http://www.hindustantimes.com/gurga...ing-gurgaon/story-Xo3IFCwrSaUXGHmvJO6JTL.html

prasad1

Active member

With demonetisation set to reduce India’s economic growth by 1% over the next one year, the job market is likely to see over 400,000 job cuts.

You should worry if you work in the e-commerce sector, since firms could handover around 200,000 pink slips in the next one year. “Cash on delivery being almost 70% of the overall e-commerce business, the sector is likely to take a hit and lose almost 20% of their headcount in the next few months,” said Rituparna Chakraborty, co-founder at staffing firm Teamlease Services. E-commerce firms currently employ around 1 million people in India.

“Companies manufacturing and selling luxury goods would also be immediately impacted,” Chakraborty added.

Real estate, construction and infrastructure are the others that are likely to feel the heat of demonetisation. Recruiters and head hunters expect the sectors to lose over 100,000 jobs in the next 12 months.

“For the next six to eight months, we could foresee job losses and freeze on hiring. Moreover, if the government’s objectives (related to demonetisation) are not be met, we should expect more challenges,” said Anandorup Ghose, director at US-based human resource consultancy Aon Hewitt. “The impact of the move will be felt across sectors dealing with consumer’s discretionary spending, including real estate and auto.”

Besides, the textiles and garments industry, which employ a substantial number of daily wagers, could be hit hard. Of the 32 million people employed by the industry, one-fifth are daily wagers, who mostly get paid in cash. “While on one hand, slow sales increase the possibility of stock returns to manufacturers or affect the order book for the next year due to unsold inventory; on the other, slow sales and consequent liquidity pressures on retailers can result in stretched payments to manufacturers,” according to rating firm ICRA. Similarly, 20% of the 250,000 workers in the leather industry will also be impacted.

The impact on the job market could become severe if the recovery of cash supply in the system remained sluggish, experts said. “The impact on the job market depends on the how fast the economy recovers, how fast the money is supplied in the economy, and when the restrictions on cash withdrawals go,” said Soumya Kanti Ghosh, chief economic adviser at State Bank of India.

According to global financial services major HSBC, the government’s move to withdraw and replace high-denomination currency notes will bring ‘some benefits and some losses’ in the short term, to sectors, including financial technology, digital wallet and banking.

http://www.hindustantimes.com/busin...e-worst-hit/story-Fum0FvfDkp7ClUyYfTjvrM.html

You should worry if you work in the e-commerce sector, since firms could handover around 200,000 pink slips in the next one year. “Cash on delivery being almost 70% of the overall e-commerce business, the sector is likely to take a hit and lose almost 20% of their headcount in the next few months,” said Rituparna Chakraborty, co-founder at staffing firm Teamlease Services. E-commerce firms currently employ around 1 million people in India.

“Companies manufacturing and selling luxury goods would also be immediately impacted,” Chakraborty added.

Real estate, construction and infrastructure are the others that are likely to feel the heat of demonetisation. Recruiters and head hunters expect the sectors to lose over 100,000 jobs in the next 12 months.

“For the next six to eight months, we could foresee job losses and freeze on hiring. Moreover, if the government’s objectives (related to demonetisation) are not be met, we should expect more challenges,” said Anandorup Ghose, director at US-based human resource consultancy Aon Hewitt. “The impact of the move will be felt across sectors dealing with consumer’s discretionary spending, including real estate and auto.”

Besides, the textiles and garments industry, which employ a substantial number of daily wagers, could be hit hard. Of the 32 million people employed by the industry, one-fifth are daily wagers, who mostly get paid in cash. “While on one hand, slow sales increase the possibility of stock returns to manufacturers or affect the order book for the next year due to unsold inventory; on the other, slow sales and consequent liquidity pressures on retailers can result in stretched payments to manufacturers,” according to rating firm ICRA. Similarly, 20% of the 250,000 workers in the leather industry will also be impacted.

The impact on the job market could become severe if the recovery of cash supply in the system remained sluggish, experts said. “The impact on the job market depends on the how fast the economy recovers, how fast the money is supplied in the economy, and when the restrictions on cash withdrawals go,” said Soumya Kanti Ghosh, chief economic adviser at State Bank of India.

According to global financial services major HSBC, the government’s move to withdraw and replace high-denomination currency notes will bring ‘some benefits and some losses’ in the short term, to sectors, including financial technology, digital wallet and banking.

http://www.hindustantimes.com/busin...e-worst-hit/story-Fum0FvfDkp7ClUyYfTjvrM.html

prasad1

Active member

There's always a flip-flop side for any coin....when the demonetization scheme was coined and tossed, little did the regulatory authorities be it RBI, Min. of Finance including our PM ever thought that this will lead to acute cash crunch rather than cash less economy, and its repercussions may reverberate beyond the economic crisis leading to mass exodus of daily wagers, massive job loss for the unorganized sector and small business houses, not to mention those unwanted serpentine queues at the Bank's and ATMs. Perhaps the decision was well intended but lacked some ground realities. Poor implementation and lack of proper and adequate currency supply to cover and mitigate the banned 500 & 1000 notes was done in a very shoddy and ham handed manner. RBI was not prepared to fill the currency chest of banks to maintain hassle free supply of currency OTC over the counter. The reaction and multitude of initiatives and directives were more like some knee jerk reaction to thwart the eruptive symptoms of the disease rather than reaching for its root cause and long term cure. Our Indian economy is hanging in limbo like some 'trishanku' between those highly developed cash less nations and predominantly cash based developing countries, where currency money rules the roost. It's neither here nor there...where pains are exceeding the gains.

prasad1

Active member

Exactly a month ago, the government announced a surprise recall of Rs 500 and Rs 1000 notes as part of its efforts to purge illegal money from the market and cull counterfeit currency.

Since then, millions of people have lined up outside banks and ATMs in an effort to exchange or deposit scrapped currency but been badly affected by snaking queues and a cash crunch, especially across the countryside.

Here’s a look at how Prime Minister Narendra Modi’s move – billed as the most sweeping economic decision in the past two decades – has panned out over the past 30 days.

Long queues, painful exchanges

From Day One, the culling of high-value banknotes – which made up 86% of the currency in circulation by value -- sparked chaos at banks and ATMs with long queues of people anxious to deposit old currency.

The situation has improved somewhat in certain pockets but a shortage of new Rs 2,000 and Rs 500 notes has ensured most cities and rural areas have seen little improvement. Pay Day has only added to the frenzy as several people have died in queues and out of shock.

For the first couple of weeks after the note culling was announced, the government changed rules almost daily, triggering charges that the demonetisation decision had been taken with little planning.

The finance ministry repeatedly tinkered with withdrawal and exchange limits – especially with Jan Dhan accounts -- and caused outrage when it abruptly stopped the exchange of old notes.

The government’s decision has deadlocked Parliament’s winter session with the Congress and other opposition parties calling the demonetisation move as detrimental to the poor and farmers. Outside Parliament, West Bengal chief minister Mamata Banerjee has emerged as the face of protests.

As it became clear that the fallout of the currency cull will not be mitigated in the short run, experts began warning of a domino effect on economic growth. The Reserve Bank of India has already shaved 0.5 percentage points off its growth forecast for 2016-17 amid a slowdown in auto, retail sector and havoc in the rural economy.

The scrapping of high-value banknotes was aimed at junking fake currency but within days of the new notes being introduced, a number of people were caught from various parts of the country with fake notes. People also devised innovative ways to deal with the demonetisation pain, from deputing “chotus” to resorting to tricks.

http://www.hindustantimes.com/india...litical-war/story-ZEoqn6xOIM9DCFY4PgDhlJ.html

Since then, millions of people have lined up outside banks and ATMs in an effort to exchange or deposit scrapped currency but been badly affected by snaking queues and a cash crunch, especially across the countryside.

Here’s a look at how Prime Minister Narendra Modi’s move – billed as the most sweeping economic decision in the past two decades – has panned out over the past 30 days.

Long queues, painful exchanges

From Day One, the culling of high-value banknotes – which made up 86% of the currency in circulation by value -- sparked chaos at banks and ATMs with long queues of people anxious to deposit old currency.

The situation has improved somewhat in certain pockets but a shortage of new Rs 2,000 and Rs 500 notes has ensured most cities and rural areas have seen little improvement. Pay Day has only added to the frenzy as several people have died in queues and out of shock.

For the first couple of weeks after the note culling was announced, the government changed rules almost daily, triggering charges that the demonetisation decision had been taken with little planning.

The finance ministry repeatedly tinkered with withdrawal and exchange limits – especially with Jan Dhan accounts -- and caused outrage when it abruptly stopped the exchange of old notes.

The government’s decision has deadlocked Parliament’s winter session with the Congress and other opposition parties calling the demonetisation move as detrimental to the poor and farmers. Outside Parliament, West Bengal chief minister Mamata Banerjee has emerged as the face of protests.

As it became clear that the fallout of the currency cull will not be mitigated in the short run, experts began warning of a domino effect on economic growth. The Reserve Bank of India has already shaved 0.5 percentage points off its growth forecast for 2016-17 amid a slowdown in auto, retail sector and havoc in the rural economy.

The scrapping of high-value banknotes was aimed at junking fake currency but within days of the new notes being introduced, a number of people were caught from various parts of the country with fake notes. People also devised innovative ways to deal with the demonetisation pain, from deputing “chotus” to resorting to tricks.

http://www.hindustantimes.com/india...litical-war/story-ZEoqn6xOIM9DCFY4PgDhlJ.html

As I said, there is much work to be done before taking a leap. Modi has skipped some steps in his eagerness to portray himself as the "vanquisher of black money".

The fellow seems to be out of his mind right now. When basic necessities are lacking in most rural areas, and providing continuous electricity and water is a challenge, when connectivity through roads is shoddy, when illiteracy is still in significant numbers, bullet trains and credit cards are introduced. What a cruel joke.

The fellow seems to be out of his mind right now. When basic necessities are lacking in most rural areas, and providing continuous electricity and water is a challenge, when connectivity through roads is shoddy, when illiteracy is still in significant numbers, bullet trains and credit cards are introduced. What a cruel joke.

For penniless …….cashless situation makes no difference.

Pounds ... account-full and pocketful with cards………. cashless situation makes them to preach and advise others.

Very few pennies in pocket and some pennies in accounts ……………..cashless situation makes them to totter in streets with the mourning ……………one a penny…………two a penny hot cross bun.

Pounds ... account-full and pocketful with cards………. cashless situation makes them to preach and advise others.

Very few pennies in pocket and some pennies in accounts ……………..cashless situation makes them to totter in streets with the mourning ……………one a penny…………two a penny hot cross bun.

prasad1

Active member

[FONT="]With demonetisation set to reduce India’s economic growth by 1% over the next one year, the job market is likely to see over 400,000 job cuts.

[/FONT]http://www.hindustantimes.com/business-news/demonetisation-could-take-away-400-000-jobs-e-com-to-be-worst-hit/story-Fum0FvfDkp7ClUyYfTjvrM.html

[/FONT]http://www.hindustantimes.com/business-news/demonetisation-could-take-away-400-000-jobs-e-com-to-be-worst-hit/story-Fum0FvfDkp7ClUyYfTjvrM.html

prasad1

Active member

Out of cash. A month after demonetisation this sign continues to greet people across the country at banks as well as ATM kiosks.

Cash is hard to come by. Or is it?

More than 85,000 new Rs 2,000 notes — enough to fill 141 ATMs — have been confiscated over suspicion that they were acquired illegally in connivance with bank officials.

The government’s November 8 decision to scrap Rs 500 and Rs 1,000 banknotes, which accounted for 86% of the currency in circulation, and restrictions on cash withdrawals has led to a cash crunch, forcing people to stand in lines for hours, sometimes even overnight.

But not everyone is struggling.

Income tax data reveals that nearly Rs 17. 2 crore have been seized in 2000-rupee bills. The 2000-rupee note was the first to be introduced after the currency cull, followed by a new Rs 500 bill.

http://www.hindustantimes.com/india...onetisation/story-ZFidspQbfQqcIGbQPcgtPJ.html

Going wrong way.

Cash is hard to come by. Or is it?

More than 85,000 new Rs 2,000 notes — enough to fill 141 ATMs — have been confiscated over suspicion that they were acquired illegally in connivance with bank officials.

The government’s November 8 decision to scrap Rs 500 and Rs 1,000 banknotes, which accounted for 86% of the currency in circulation, and restrictions on cash withdrawals has led to a cash crunch, forcing people to stand in lines for hours, sometimes even overnight.

But not everyone is struggling.

Income tax data reveals that nearly Rs 17. 2 crore have been seized in 2000-rupee bills. The 2000-rupee note was the first to be introduced after the currency cull, followed by a new Rs 500 bill.

http://www.hindustantimes.com/india...onetisation/story-ZFidspQbfQqcIGbQPcgtPJ.html

Going wrong way.

Bank officials and security men at the gates of banks have become VIPs.

Decent people [read senior citizens] have to beg them to get money out of their own accounts.

Banks and not govt decide how much to give to each person based on cash received by them daily and 24000 limit is only on paper.

ATMs -very few -mostly of SBI work and mostly they also run out of cash fast.

The poor and those with no contacts in banks are really suffering in cold climate of northern cities.

The pain is likely to be prolonged -another month at least.Let us hope for the best

Decent people [read senior citizens] have to beg them to get money out of their own accounts.

Banks and not govt decide how much to give to each person based on cash received by them daily and 24000 limit is only on paper.

ATMs -very few -mostly of SBI work and mostly they also run out of cash fast.

The poor and those with no contacts in banks are really suffering in cold climate of northern cities.

The pain is likely to be prolonged -another month at least.Let us hope for the best

V

V.Balasubramani

Guest

Demonetisation effect: How the common man is going digital amidst cash crunch

Azhar Pasha Owner, Global Key Makers

Azhar Pasha, a locksmith in central Bengaluru, realised that customers who came to get their new keys were often helpless and asked for credit. One customer, a manager with online payments company Freecharge, showed him a way out and opened an account for his store, Global Key Makers. Pasha could now accept cash on his phone.

“I have been in this business for 10 years. This is the first time I have moved towards cashless transactions,” said Pasha.

Soon, Paytm and MPoint representatives got in touch and set up their payment systems on Pasha’s mobile phone.

Pasha now accepts mobile payments for all his services and is going to the next level. “I have reached out to Axis Bank to get a PoS (point of sale) machine. It will take a while. Meanwhile, these wallets are extremely helpful,” he said.

Read more at:

http://economictimes.indiatimes.com...ofinterest&utm_medium=text&utm_campaign=cppst

Azhar Pasha Owner, Global Key Makers

Azhar Pasha, a locksmith in central Bengaluru, realised that customers who came to get their new keys were often helpless and asked for credit. One customer, a manager with online payments company Freecharge, showed him a way out and opened an account for his store, Global Key Makers. Pasha could now accept cash on his phone.

“I have been in this business for 10 years. This is the first time I have moved towards cashless transactions,” said Pasha.

Soon, Paytm and MPoint representatives got in touch and set up their payment systems on Pasha’s mobile phone.

Pasha now accepts mobile payments for all his services and is going to the next level. “I have reached out to Axis Bank to get a PoS (point of sale) machine. It will take a while. Meanwhile, these wallets are extremely helpful,” he said.

Read more at:

http://economictimes.indiatimes.com...ofinterest&utm_medium=text&utm_campaign=cppst

- Status

- Not open for further replies.

Latest ads

-

For rent [Property for Rent] 2 bhk for rent2 bhk rent in Thiruvanmiyur chennai

- tbs (+0 /0 /-0)

- Updated:

-

Wanted Wanted female Brahmin cook and caretaker in CoimbatoreNeed a female Brahmin cook and caretaker in Kovaipudur, Coimbatore

- Peace$ (+0 /0 /-0)

- Updated:

- Expires

-

Wanted [Want to Buy] Property close to Perumal TemplePlanning to create a nandavanam for pushpa kainkaryam of Perumal.

- Balamuruganpulsars (+0 /0 /-0)

- Updated:

- Expires

-

-

For rent FOR RENT-Kolathur, 2 BHK 16000rs. onlyBrand new 2 Bedroom house for rent in kolathur_16000

- sang (+0 /0 /-0)

- Updated:

- Expires